Double Entry for Disposal of Asset

Disposal of Fixed Assets. You assign special characters to asset number formats on the fixed assets.

Disposal Of Pp E Principlesofaccounting Com

Remove the asset from the.

. To create a disposal journal go to Fixed assets Journal entries Fixed assets journal and then on the Action Pane select Lines. Accumulated depreciation from the balance sheet as well. The double entry to record the proceeds on disposal of assets in debit.

May 19 2022. A fixed asset is written off when it is determined that there is no further use for the asset or if the asset is sold off or otherwise disposed of. Eventually all fixed assets non-current assets bought for resale reach their end of life.

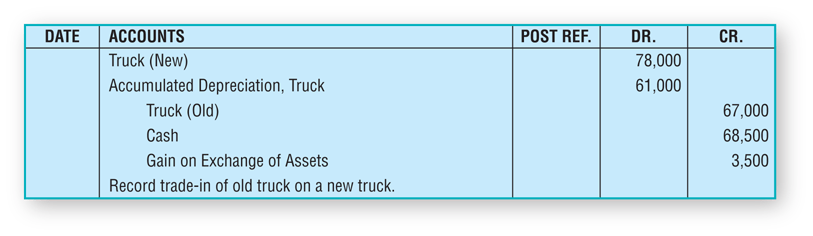

A fixed asset trade in journal entry is used to post the acquisition of a new motor vehicle in exchange for cash and a trade in allowance on an old vehicle. Transfer the asset to. Select Disposal scrap and then select a.

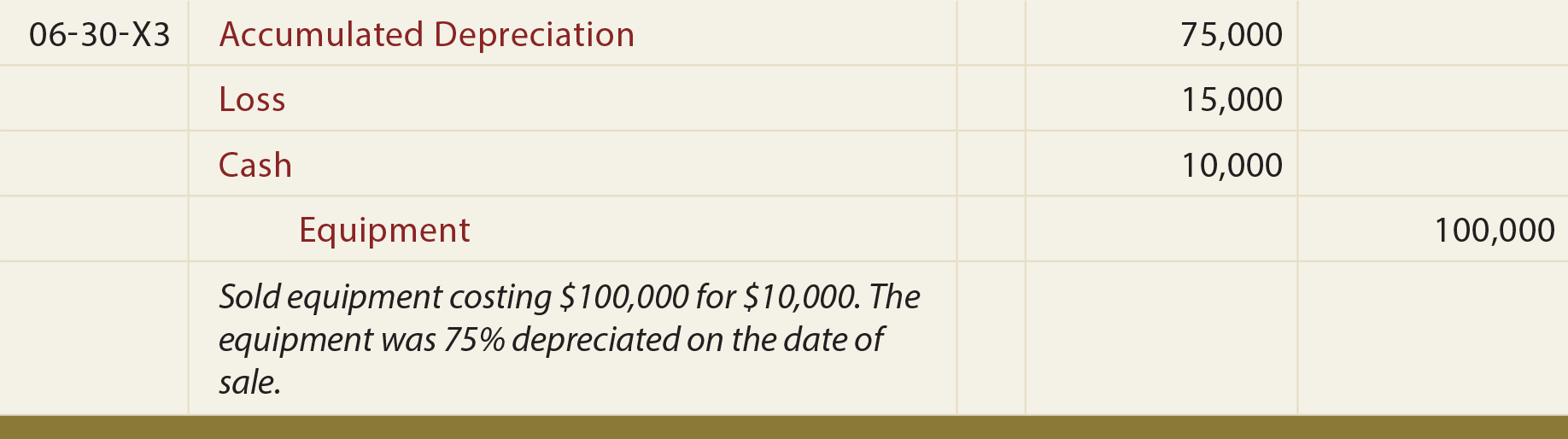

Accounting for the disposal of capital assets 11 Introduction When a capital or non-current asset is sold then there are two main aspects to the accounting for this disposal. Asset disposal also called de-recognition is the removal of a long-term asset from a companys financial records. Usual practice to record sale or disposal of non-current asset is done by opening a temporary account named Disposal Ac.

The accounting for disposal of fixed assets can be summarized as follows. Disposal of fixed assets is accounted for by removing cost of the asset and any related accumulated depreciation from balance sheet recording receipt of cash and. The double entry to record the proceeds on disposal of assets in debit.

First we need to. Removing the asset removing the accumulated depreciation recording the receipt of cash and recording the gain. The remaining value of the fixed asset needs to be shown as an expense on the profit and loss account and reducing the fixed asset value in the balance sheet.

The journal entry will have four parts. This is completed by creating. Record cash receive or the receivable created from the sale.

To remove the asset credit the original. The double entry for the part exchange value is. Disposal of Fixed Assets Double Entry Example.

A write off involves. If there is a difference between disposal proceeds and carrying. ZIMSEC O Level Principles of Accounts Notes.

The accounting is done in following steps. Credit asset disposal account. The journal entry for gain or loss on fixed asset disposal above will remove both the disposed fixed asset and its related item eg.

Disposal Of Fixed Assets Journal Entries Double Entry Bookkeeping

Fixed Asset Accounting Disposal Of Fixed Asset Accounting Corner

No comments for "Double Entry for Disposal of Asset"

Post a Comment